面对环境危机现实的经济理论

在人类世时代[1],经济活动与环境之间的关系问题,无论是自然资源的开发还是自然环境的退化,都不可能再被排除至经济分析的范围之外。经济理论提出了哪些工具来管理它们?自20世纪60年代以来,环境问题在社会关注领域持续得到重视。除了日益恶化的生物多样性、空气质量、温室气体浓度或饮用水供应外,一系列重大灾害也引起了公众舆论和政府的警惕。为了应对这些环境影响,政府出台一系列公共政策进一步改善物质条件,与保护一定的环境质量相协调。面对人口增长,政府往往束手无策,只能专注于经济活动的后果。由于规章制度运行伊始,经常出现不遵守所规定的标准或控制成本过高的问题,许多政府从20世纪70年代开始转向经济理论倡导的其他工具。有了几十年的后见之明,我们是否可以认为这些工具已经兑现了它们所有的承诺?

随着19世纪末的第二次工业革命,经济全球化,20世纪前所未有的人口和经济增长,经济环境关系问题越来越难以脱离经济分析的范围。无论是在开发自然资源还是自然环境退化方面,这些问题都越来越严重,有些人甚至认为,持续的增长正危及地球。经济理论是否提出了适当的工具来应对当前和未来环境危机?

1. 自然资源的价格

众所周知,自然资源是免费的。在这个问题上,弗雷德里克·巴斯夏(Frédéric Basciat,1801-1850)解释得最清楚:“纽卡斯尔的煤是免费提供给所有人的,就像溪水一样,唯一条件是大家自取自用,要么就让为我们挖煤的人承受这一惩罚(图1)。当我们购买煤炭时,购买的不是煤炭本身,而是开采和运输煤炭所必须做的工作。”[2]。然而,采矿造成的土地存量减少对子孙后代来说将是一种损失。一些19世纪的经济学家已经提到了资源的跨期配置问题[3],但直到1931年哈罗德·霍特林(Harold Hotelling,1895-1973)才在文章中第一次对此作出解释[4]。

资源是自然给予的,但根据有效的司法管辖区,它们是可被占用的。美国的“自然资源保护主义者”认为价格体系并没有将对自然资源的合理管理考虑在内,为了回应这一观点,霍特林定义了一种规则,对于随着开采而减少的资源的所有者,在有限的时间范围内使其利润的贴现价值最大化[5]。该规则可表述如下(图2):

- 资源所有者在任何时候都有两种选择:要么今天再开采一些资源,出售并将其收益存起来,要么将资源闲置,等待一段时间,然后在市场上出售开采的部分;

- 通过均衡市场价格和边际生产成本,确定资源的最佳开采率,在边际生产成本的基础上加上表示库存有限性的稀缺租金,从而确定资源未来不可获得;在此基础上,只要其边际成本不高于其边际收益(数量x售价),开采就符合运营商的利益;

- 自然资源的价格,以及由此产生的租金,必须以与利率(或贴现率)相等的速率增长,这使得就地保护资源等同于开采,也等于以其出售所得为回报的投资。

根据这一规则,自然资源的总量构成了所有者的租金,证明了超出边际成本的价格上涨是合理的。与大卫·李嘉图(David Ricardo)的级差地租不同,这种稀缺租金将被开采的自然资源(无论是否可再生)与其他商品或服务区分开来,但在这样做时,它被视为资本,并以其占用为前提。在缺乏资源的情况下(例如公海渔业),那些对开放资源(即无法被据为己有的资源)的最佳管理不感兴趣的公司将寻求尽快开发这种资源,因此可能会将其耗尽。一些经济学家提出的关于可占用自然资源私有化的答案并不总是适用的,特别是当涉及到生物多样性等全球共同利益时[6]。

除了霍特林分析的生产者微观经济逻辑之外,在1972年发表关于“增长极限”的梅多斯报告(图3)之后,自自然资源的开发问题将变成全球或宏观经济问题。对于参与讨论的经济学家来说,自然资源,无论是否可再生,都可以被像任何其他商品一样对待。因此,它们被重新引入柯布-道格拉斯型生产函数的增长模型中:在这些所谓的KLEM生产函数中,自然资源:能源(E)和原材料(M)通过替代弹性与其他生产要素:技术资本(K)和劳动力(L)相联系,这意味着在价格上涨的情况下,E和M可以用K和L代替。

因此,自然资源的枯竭不再令人担忧,因为其价格的上涨减少了需求,同时技术进步[7]使得新的资源变得容易获得,从而实现盈利。杰弗里·克劳特克雷默(Jeffrey Krautkraemer)据此提出一个悖论,根据这个悖论,不可再生的自然资源(可以被占用并因此受益于价格调整)比可再生的自然资源(不能被占用)受到的耗竭威胁更小[8]。

但围绕这一问题也出现了其他争议,特别是在新古典主义“标准”经济学家和“生态经济”支持者之间。前者认为,如果投资充足,从社会福利的角度来看,自然资源的破坏可以通过人工资本的积累得到补偿:这被称为“弱可持续性”。后者则认为,破坏自然资源不可能不受惩罚,发展模式必须建立在保护关键自然资源存量的基础上:这就是“强可持续性”的概念。从这两个愿景中得出的政策建议显然非常不同,因为它们要么导致技术乐观主义,要么与之相反,导致严格的保守主义[9]。

2. 排放和污染的成本

在自然资源开采增加的同时,工业世界的经济活动向自然环境倾倒了越来越多的固体、液体或气体废弃物。对其负责的经济主体(污染者)会因此影响商品或服务的价值,无论是集体的(所有人呼吸的空气)还是专用的(产品制造过程中使用的水)。这种做法不受公共机关的管制,只要不推动价格形成,就会扭曲贸易条件。外部效应理论建议根据明确的原则和条件来弥补这一缺陷[10]。

外部性是指一个经济主体在没有金钱补偿的情况下对其他主体的活动所产生的影响,这种影响能够转化为优势(正外部性),也可能损害和妨碍其他主体活动(负外部性)。这种影响通过扭曲每个主体做出决策所依据的成本,是社会活动分配缺陷的根源,因此也是经济效率低下的根源。在计算森林开发的利润时,如果忽略了森林对气候或水资源的调节作用,就会高估利润,过度开发森林。同样,在城市地区使用机动车辆,迄今为止都忽视了空气污染对健康的影响,导致了这种交通方式的过度使用。

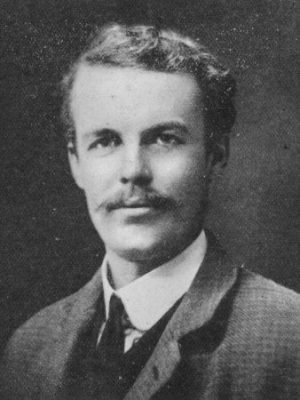

根据1920年阿瑟·赛斯尔·庇古(Arthur C.Pigou[11].)提出的经济理论,可以通过将外部性内部化来避免此类问题,即让污染者为其造成的污染付费(污染者付费原则)。这种操作旨在反映环境的价值或社会成本,并构成发送给经济主体的“价格信号”。然而,实际应用比理论方法复杂得多。

但是,以货币形式确定和量化外部效应就更加困难了,因为它是分散的,在或多或少的一段时间内对许多因素的影响是不均匀的,而且往往伴随着复杂的自然环境干扰(协同效应、阈值效应、放大效应、不可逆效应)。例如,森林的消失并给护林人、猎人或周日来散步的人带来的外部性肯定不同,特别是如果我们考虑期权价值,即经济主体赋予未来使用的价值[12]。由于缺乏类似清洁空气或清洁水等服务的市场,必须直接(通过调查或“意愿价值评估”,估算低污染地区住宅的定价过高下的支付意愿)或间接估价(对某些污染物造成的生命损失价值的估算)。

假设估价困难已经克服,但将商品和服务价格的外部影响内部化的方法尚未确定。经济分析提出了两个方案。

3. 庇古税

庇古认为,外部性的存在将私人成本与经济活动的社会成本分开,这与追求集体福利和公平背道而驰(图4)。可以通过向“污染者征收与其污染活动造成的边际社会损失相等的税”来缩小差距[13]。通过将成本和利润分配给污染者,税收恢复了考虑社会成本的条件,并使实现最佳的集体福利成为可能。尽管庇古税的污染水平是根据成本效益计算而确定的,但仍然存在以“最优”水平衡量外部成本的固有问题。实际上,在追求高成本效果的计算逻辑中,通常优选由基于专家判断的政府标准设定的水平。

4. 污染权或排放限额市场

第二种方法由罗纳德·科斯(Ronald Coase)[14]在另一篇原创文章《社会成本问题》(The problem of social cost) [15]中首次提出。但这是以自由批评对公众干预主义的名义,并提议允许污染者和受害者之间进行直接谈判,直到就可接受的污染水平达成自发协议。在这种情况下,国家的作用是适当规定受污染者和污染者对环境的使用权或所有权。然后由经济主体进行谈判,直到一些人承担的减少污染的边际成本与其他人的边际支付意愿对等。

然而,科斯对经济现实的观察非常敏锐,不会忽视“交易成本”(他的一个原创概念[16])在许多情况下会限制有效谈判的可能性。约翰·戴尔斯(John Dales)在1968年提出建立环境权[17]市场的建议,从而为科斯方法中的困难提供一个切实可行的解决方案。正是在这些“许可证”或“污染权”市场上,不同主体之间的谈判才更容易进行。

庇古法面临评估污染成本的困难,而第二种方法面临评估可接受污染水平的困难。因为只有当国家或其他公共机关对进入或利用环境的权利及其在各主体之间的分配方式加以限制时,配额市场才能发挥作用。

假设已全部清除没有不确定性,按价格或数量进行环境监管的两种方法是等效的。但现实情况却大不相同,因为环境问题中的不确定性无处不在。考虑到损害成本曲线和污染减少曲线的相对斜率,马丁·威兹曼(Martin Weitzman)提供了一个出色的论证,从理论上使决策成为可能:在存在不确定性的情况下,当减少成本的斜率大于损害成本的斜率时,宜通过价格(税收)而不是数量(许可证)进行干预,反之亦然[18]。

5. 现实考验:不断退化和环境灾难

如果说自20世纪60年代以来,环境问题在社会关注的领域中一直占据一席之地,那是因为它们反映了环境退化的逐渐加剧和层出不穷的灾难。一系列事件震惊了公众舆论和各国政府:1977年,日本水俣湾汞泄漏导致的疾病和畸形;1967年3月托雷峡谷号油轮搁浅、1978年3月阿莫科·卡迪兹号油轮搁浅、1989年3月埃克森·瓦尔迪兹号油轮搁浅都导致了石油泄漏;1976年7月,塞维索(意大利)化工厂发生爆炸;1984年12月,博帕尔(印度)化工厂发生爆炸;1973年和1979年的石油危机被视为过度开采地下资源导致的碳氢化合物短缺的开始;1979年3月三里岛(美国)和1986年4月切尔诺贝利(乌克兰)核事故带来大规模辐射风险,之后在2011年3月还发生了福岛灾难(日本)。

世界各地对这些环境影响的反应有很大差异,但几乎所有地方都根据预防原则制订了更高的环境标准和公共政策。

6. 自然资源的开发

不可能将所有可再生和不可再生的自然资源放在同一个篮子里,但可以从过去几十年的开采和价格演变中吸取一些教训。从短期和中期来看,自然资源价格波动剧烈,但从长期来看,出于若干原因,其价格并没有上涨。

与霍特林的假设相反,只要发现新的矿藏或将可能的资源转化为已探明储量的工作继续进行,地球的资源储备就没有被耗尽。由于科学和技术的进步,例如在碳氢化合物方面,利用巴西海岸的深海资源或德克萨斯州的页岩油气已经成为可能[19]。

除了供应的不确定性外,还存在需求的不确定性,因为通过使用替代品,今天价值很高的资源在未来可能不再如此。例如,由于能源部门增加使用不排放温室气体的能源,对煤炭、天然气或石油的需求可能会大幅减少。在这种情况下,很难想象完全知情的运营商能够平衡当前和未来开采。因此,理性不是要在被开采资源的整个生命周期内实现收益最大化,而是要求缩短这一周期,这一点长期以来适用于许多采矿业。正如麻省理工学院最好的石油专家之一莫里斯·阿德尔曼所言,产油国的逻辑通常是“拿钱就跑”。

这些决定的结果众所周知:采掘率的强劲增长,以及由此带来的供应增长,导致价格下跌,而需求的刺激推迟了技术变革和产业结构调整。它加剧了环境的恶化,加剧了代际不公,而这种不公本来可以通过在稀缺租金支持下定期上涨价格轨迹来避免。不可再生资源的高低价格阶段的连续性支持了克劳特克雷默的分析:这些资源通常在市场上交易,尽管价格信号不稳定,但它们允许供应和需求在长期内进行调整。皮埃尔-诺埃尔·吉罗(Pierre-Noël Giraud)对化石资源和能源气候问题的看法也类似。他认为,化石燃料的问题不在于资源本身,而在于垃圾(二氧化碳是燃烧产生的废物,也是大气中的垃圾)[20]。

7. 环境准入权的拒绝税和合同

经济分析强调的负外部性通过环境税被考虑在内,现在世界上所有国家都广泛使用环境税[21]。例如,在法国,其中一些已经被证实有效:

水务局的征费可以追溯到1964年的《水法》,对水资源开采和存在水污染风险的活动征税:其收益以贷款或补贴的形式重新分配给地方机关、工业公司和农民,用于减少污染;

- 国内能源产品消费税(TICPE)因其对燃料价格的强烈影响而闻名;它是自2015年以来最重要的环境税,占所有环境税的近50%;

- 2012年以来,TICPE增设了气候和能源贡献这一与碳相关的税目,2015年绿色增长能源转型法强化突出这一点,到2030年,每吨二氧化碳的税款将增长至100欧元;

- 污染活动一般税(TGAP)适用于空气污染、农药、废弃物或环境难以吸收的产品,如油、润滑制剂或洗涤剂。

总的来说,大多数税收都被证明是有效的,但它们的广泛使用往往受到公众舆论或经济主体的抗拒。这种态度是难以对农业硝酸盐或二氧化碳排放征税的根源。类似地,尽管重型货车生态税对交通运输的再平衡具有积极意义,但它未能在法国站稳脚跟[22]。至于针对碳排放的征税,上次计划上调引发了2018年冬季的社会危机,到2019年年中仍悬而未决。

当税收被认为对公司惩罚太重,而公共行政机构新设税种成本又太高时,可以通过引入污染权市场来替代。然而,这方面的实验仍然有限。美国是第一个这样做的国家,1990年《清洁空气法修正案》(CAAA)以二氧化硫(SO2)全国市场的形式建立了“限额和交易体系”。这项实验相当积极的效果[23]推动建立二氧化碳(CO2)的类似市场:在2003年就有350家公司参与芝加哥气候交易所的交易;2009年,《区域温室气体倡议》在美国东北部10个州推行;2010年的《中西部地区温室气体减排协议》和2012年的《西部气候倡议》将这类市场扩展到了其他州。

在美国以外,继2005年有73家公司参与的日本自愿排放交易计划之后,澳大利亚和新西兰启动的项目并没有得到跟进。因此,欧洲在打造污染权的市场上经验最为丰富,排在最前的是斯堪的纳维亚国家,然后是欧盟(EU)。

虽然美国在2000年放弃了国际许可证市场的前景,但欧盟在2005年建立了欧盟排放权交易体系(EU-ETS),以表明其对气候领导力的承诺。为了实现《京都议定书》[24]规定的温室气体减排目标,排放配额分配给了排放温室气体的大型工业公司[25]:排放低于配额的“良性”公司可以在市场上将配额出售给不良的、排放超出预期的公司。根据这次会议,二氧化碳的价格必须高到足以鼓励减排。

在试点阶段(2005年1月至2007年12月)之后,欧盟ETS进入了学习阶段(2008年1月至2012年12月),并继续进行第三阶段(2013年1月至2020年12月)。在这最后一个阶段及以后,主要的变化涉及以单一的欧洲排放上限取代各国排放上限、逐步减少配额、放弃自由分配,以及最重要的是建立战略储备。这些改革的目的是在2020年将每吨二氧化碳的价格提高到17欧元,然后在2030年提高到30欧元,而自2012年以来,每吨二氧化碳的价格一直在5欧元到10欧元之间变化,这一水平被认为远远不足以直接投资于排放较少的技术(图5)。如今,必须指出的是,尽管补贴市场的改革和战略储备的建立使价格得以调整,但欧洲内部能源利益的分歧尚未使人们能够真正启动必要的投资轨道变革。尽管价格信号不稳定是配额市场的固有特征,但其长期有效性仍然是个问题。

如今,在评估二氧化碳配额市场的未来时,我们必须考虑中国方面。在七个试点市场测试不同市场结构的初始阶段后,中国现在正朝着建立全国性市场的方向迈进[26]。最初只涉及电力部门。其目标将由每千瓦时二氧化碳克数的排放标准来确定,并随着时间的推移而递减。与其他领域一样,中国致力于吸取经验教训。研究其他地方遇到的困难,并对不同方案进行内部测试,结果或许表明,与世界其他地区相比,中国二氧化碳市场有更有利的前景[27]。

8. 总结

经济学家必须意识到他们能够对公共政策的定义做出贡献的重要性,但他们也必须考虑到其学科的局限性:

- “成本效益”分析面临重大困难,特别是在环境产品价值的计算方面,这使得经济学家很难理解决策的所有参数;

- 经济学家的职能是根据给定的社会环境标准,找出最有效或成本最低的解决方案;

- 在追求效率的过程中,市场和价格信号并不是所有问题的解决方案,这与那些主张为二氧化碳设定单一全球价格以阻止全球变暖的人的想法相反。它们只是改变破坏环境的某些行为的必要工具;

- 经济分析仅限于市场的运作,无法考虑经济通过社会融入生物圈的所有关系。

我们必须坚持三条思考和行动路线

- 将与不能占用的公共物品有关的决定置于经济理论范围之外,特别是在应用预防原则的情况下;

- 作其他决策时由“成本-效益”转为“成果效果”的方法,因为公共机关有健全的科学专门知识,比起几乎不可能评估[28]的边际成本计算,能更好地确定可接受的环境损害水平[28];

- 发展与其他社会科学的互动,以更好地了解公民消费者在生态转型中的行为,并描述环境友好型创新的“社会技术可行性”条件。

参考资料及说明

[1] 由诺贝尔奖获得者保罗·克鲁岑(Paul Krutzen)提出的人类世概念指的是人类活动对地球状态产生可识别和不可逆转影响的历史时期。

[2] 引自帕塞特·雷内(1979年)。经济与生活。巴黎:《经济学》,292页(第38页)。

[3] 特别是Jevons Stanley W(1965年)。煤炭问题。纽约:奥古斯都·M·凯利出版社,第467页。在这本1865年出版的书中,作者提出了一个论点,即英国继续以同样的速度开采煤炭意味着更深的矿井挖掘,因此成本的增加将不可避免地影响英国经济在面对德国或美国竞争时的竞争力,运营成本较低矿山的受益人。

[4] 霍特林·哈罗德(1931年)。可耗竭资源的经济学。《政治经济学杂志》,第39卷,第137-175页。

[5] 以下主要是受费雯·弗兰克·多米尼克的启发。《经济》,同前,第68-69页以及Bretschger Lucas和Leinert Lisa(2010年)。自然资源价格的演变。经济生活。《政治经济评论》,第11期,第4-9页。

[6] 全球公地或全球公共物品包括文化或自然财产,这些财产不应属于任何国家或企业主权,因为它们是人类共同遗产(PCH)的一部分。不幸的是,不可能给出一个准确的清单,因为尽管有国际努力,特别是在教科文组织的框架内,它们的定义仍然没有被所有国家接受。全球公域

[7] 斯蒂格利茨,约瑟夫E.(1974)。可耗竭自然资源的增长:高效和最佳的增长路径。经济研究回顾,可耗竭资源经济学专题讨论会。罗伯特·M·索洛(1993)。这几乎是迈向可持续发展的实际步骤。资源政策19(3):162-72。

[8] Krautkaemer J.,《自然资源稀缺性经济学:辩论的现状》,未来资源,2005年,https://media.rff.org/documents/RFF-DP-05-14.pdf

[9] 对这些争议的全面回顾可以在Pezzey John C.V.和Toman Michael(2002)中找到。可持续性经济学。对期刊文章的评论。未来资源,1月,下午25时。

[10] Cropper Maureen L. 和 Oates Wallace E.《环境经济学:一项调查》。《经济文献杂志》,第XXX卷,6月,第675-740页。

[11] Pigou A.C.,福利经济学,1920年,files.libertyfund.org/files/1410/Pigou_0316.pdf

[12] 亨利·克劳德(1990年)。经济效率和道德要求:公寓环境。《经济评论》,第41期,第195-214页。

[13] 费雯丽·弗朗克·多米尼克。《经济》,同前,第页。58-61.

[14] 罗纳德·科斯(Ronald Coase)是一位英国经济学家(1910-2013年),他的文章《公司的性质》(1937年)特别出名,这篇文章的法文译本为《公司的性质》,法国经济评论,1987年,第二卷/1,第133-163页。

[15] https://www.law.uchicago.edu/files/file/coase-problem.pdf

[16] 这些是任何交易中涉及的信息、谈判和决策、监控和执行的成本。

[17] 戴尔斯·约翰·哈克内斯(1968)。《污染、财产和价格》。多伦多大学出版社。

[18] 马丁·魏茨曼生于1942年,在哈佛大学任教。他说:Weitzman Martin L.(1974年)。价格与数量。经济研究回顾,4(4),第477-491页。魏茨曼·马丁L.(1978)。经济监管的最佳回报。《美国经济评论》,68(4),第683-692页。克里基·帕特里克(2009)。未来国际气候制度的核心:税收还是二氧化碳配额?在Tirole J.(编辑)。气候政策:新的国际架构。巴黎:法语文档。第261-270页。

[19] 我们从一开始就批评的石油峰值理论的支持者没有考虑到的现象。Martin Jean-Marie(1999年)。关于“廉价石油的终结”。能源政策,第27卷,2月2日,第69-72页。

[20] 《无用的人,正确使用经济》。Odile Jacob,2015年。

[21] Rotillon Gilles(2007年)。环境税,环境保护的工具。关于克罗地亚经济,第1号,第108-113页。

[22] 2013年10月,由于布莱顿“红帽”对类似于生态税的重型货车税的强烈反对,它的推出被阻止。

[23] Schmalensee Richard和Stavins Robert N.(2012)对此市场进行了非常详细的分析。SO2配额交易系统:一个大政策实验的讽刺历史。《经济展望杂志》,8月3日,第1-23页。

[24] 在关于该主题的大量文献中,可以参考欧盟ETS基础的研究成果:Ellerman a.Denny,Joskow Paul L.(2008)。透视欧盟的排放交易体系。皮尤全球气候变化中心,麻省理工学院,第50页。

[25] 配额每年由每个欧盟成员国根据过去的排放量(通过减排系数进行调整)进行分配。

[26] 韩国义等人。中国的碳排放交易。斯德哥尔摩:森林,56页,最近,中国:碳市场,Enerpress n°11 976,2017年12月22日。

[27] 该市场于2017年底启动,目前仅限于电力行业,直到2020年才能真正投入运营。

[28] 更多详情,请参见Patrick Criqui,Benoit Lefèvre(2010),B.Zuindeau主编:《可持续发展与领土》,第193页。

环境百科全书由环境和能源百科全书协会出版 (www.a3e.fr),该协会与格勒诺布尔阿尔卑斯大学和格勒诺布尔INP有合同关系,并由法国科学院赞助。

引用这篇文章: MARTIN-AMOUROUX Jean-Marie, CRIQUI Patrick (2024年2月24日), 面对环境危机现实的经济理论, 环境百科全书,咨询于 2025年1月22日 [在线ISSN 2555-0950]网址: https://www.encyclopedie-environnement.org/zh/societe-zh/economic-theories-in-the-face-of-the-realities-of-environmental-crises/.

环境百科全书中的文章是根据知识共享BY-NC-SA许可条款提供的,该许可授权复制的条件是:引用来源,不作商业使用,共享相同的初始条件,并且在每次重复使用或分发时复制知识共享BY-NC-SA许可声明。